How Peach powers SCRA compliance

Regulatory compliance has a place near the top of every lender’s priority list. But that doesn’t mean compliance is straightforward, even for lenders with the most earnest intentions. Often, legacy infrastructure is the culprit, making it difficult for lenders to take the actions clearly outlined in the law. Even regulations that haven’t changed for some time—like the Servicemembers Civil Relief Act (SCRA)—still present significant challenges for many lenders.

The SCRA grants active-duty service members the ability to request certain protections during the period of their deployment, enabling them to devote their energy to serving the country. These protections include a reduction in interest rate to a maximum of six percent on any pre-service loans. While the SCRA in its current version has been law since 2003, the number of recent enforcement actions indicates just how difficult it is for many lenders to comply with the SCRA’s interest rate protections.

For example, in October of 2022 the Department of Justice (DOJ) announced that the financial leasing arm of GM agreed to pay over $3.5 million to resolve allegations in relation to SCRA violations on thousands of service-member requests. Also in October, the DOJ announced a settlement with Westlake Financial, which failed to appropriately apply the interest rate reduction for service members. Meanwhile, the CFPB issued recent guidance signaling that underapplication of SCRA benefits is on their radar.

Blunt tools in the absence of a scalpel

The recent DOJ actions illustrate the high cost of non-compliance with the SCRA. In light of this cost, why do so many lenders still struggle with compliance? The answer primarily involves the limitations of legacy loan management systems—specifically, their inability to make retroactive changes to loans. To understand the significance of this limitation, let’s take a closer look at the details of the SCRA’s interest rate protection.

The SCRA states that “...if you took out an automobile, home, or student loan or incurred credit card debt prior to becoming a service member, then you are entitled to have your interest rate reduced to a maximum of 6 percent per year…for the entire time you are serving on active duty.” This protection stipulates that the rate reduction can be requested at any time during active duty and up to 180 days after active duty ends. So lenders must be prepared to retroactively instate a lower interest rate, effective as of some date in the past.

This modification of loan state is one of the biggest challenges for loan management software. Some loan management systems date back decades, and were designed for a much simpler set of possible actions. Even newer loan management systems may not account for the need to modify past events—because of significantly increased complexity. Loan management systems often start their life as single-use-case systems, with the aim of getting their core functionalities off the ground. But by the time these systems interact with real-life borrowers and regulations, enabling retroactive changes becomes nearly impossible.

As a result, many lenders must resort to costly, time-consuming and imprecise manual workarounds to comply with the SCRA. They may manually calculate the overpayments of past interest, then issue service credits—and zero out the interest rate going forward. Or they may resort to waiving the interest on an SCRA loan entirely—past and future. Further, many lenders have no way of reinstating interest once active duty ends. Needless to say, many lenders are stuck with clunky, costly solutions that in some cases may not even fully comply with the SCRA.

Peach’s approach to SCRA

At Peach, we brought real-life lending experience to the design of our platform. So from day one, we recognized the importance of being able to make retroactive changes to loans. (There are numerous applications beyond SCRA, including our Supported Portfolio Migration.) In the case of SCRA, Peach has long enabled lenders to retroactively change interest rates and waive past fees—as separate, manual actions.

This was functional, but the ideal way to implement SCRA is to make these changes simultaneously. We now support this capability by leveraging the power of Peach's Loan Replay™ engine, which can make changes to the ledger at any time, and then recalculate a loan’s history in light of those changes. The new combined functionality is as user-friendly for your agents as processing a payment.

Specifically, the new SCRA feature allows your agents to perform the following adjustments simultaneously on a loan of an active-duty service member:

-

Lower interest rates to 6% (and lower the recurring payment during the active-duty period to account for the interest rate reduction)

-

Waive fees, if necessary

-

Enact these changes retroactively, if necessary, and replay the loan history with the rate and fee adjustments

-

Preview the intended changes

While each of these SCRA adjustments are highly complex in themselves, involving detailed changes to loan state and financial state, ease of use is paramount. Our SCRA API endpoint allows the agent and borrower to see the combined result of simultaneously performing two replay actions (interest reduction and fee waiving) on the same loan and payment plan. In addition, we’ll automatically lower the recurring payment during the active duty period to account for the interest rate reduction. Our tool can then be used to reinstate the borrower’s previous interest rate once active duty ends.

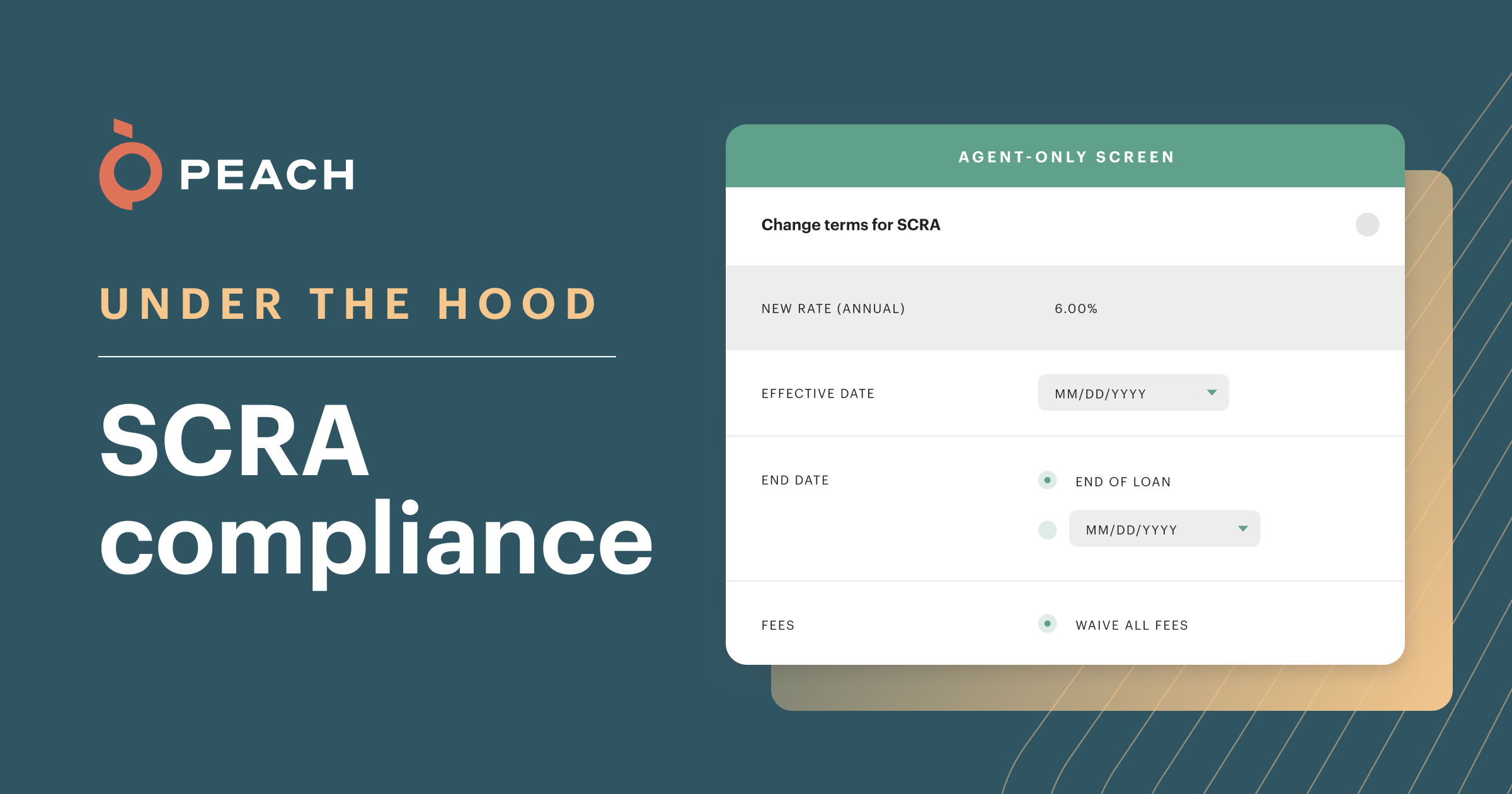

Our SCRA functionality is available via API as well as through our white-label agent tool. The white-label agent interface can be seen here:

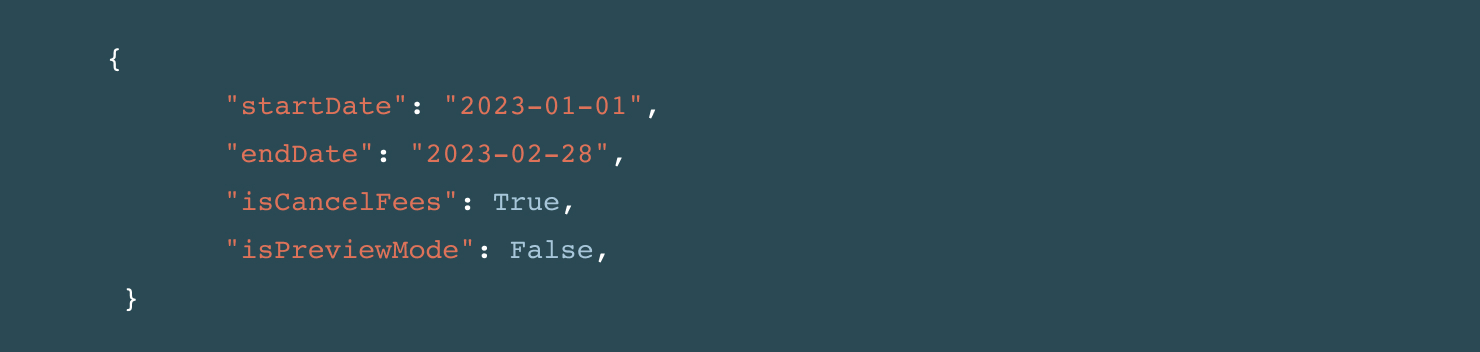

For those working directly with the API, this can be as simple as sending the following request body to the SCRA endpoint:

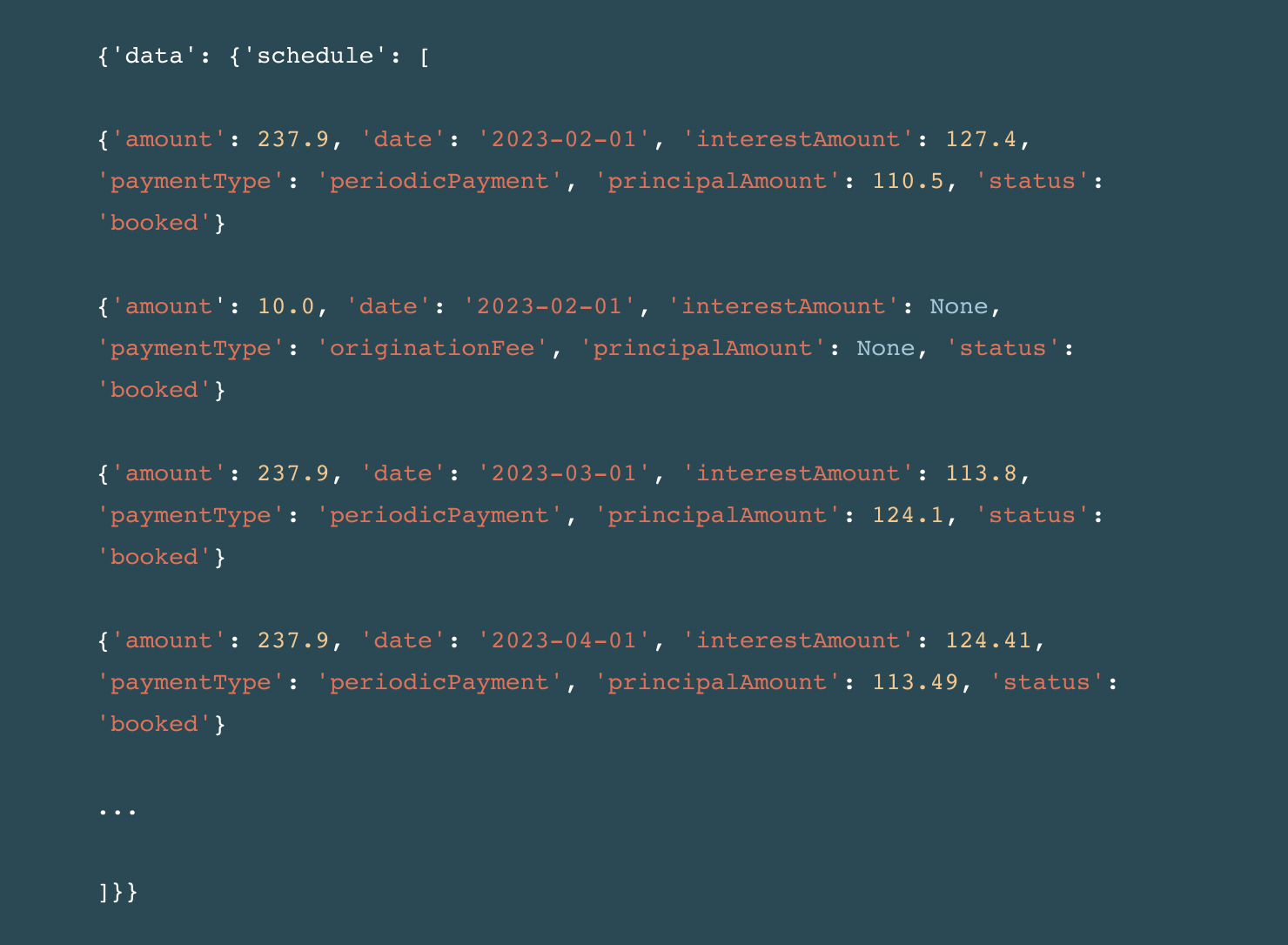

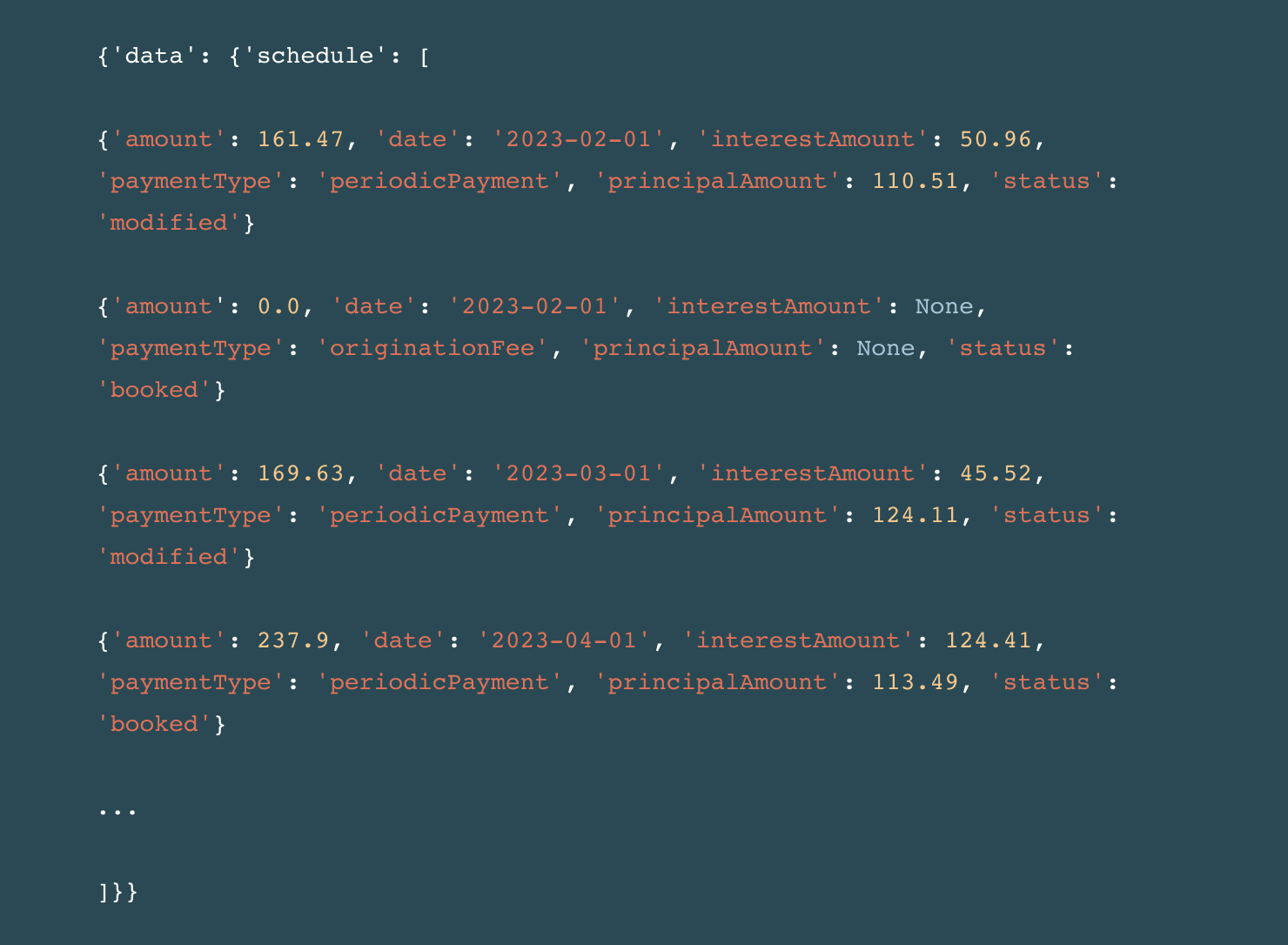

You’ll receive a response with either the actual post-SCRA adjusted payment plan or a preview of it. Below is a comparison of a payment plan prior to the SCRA adjustment, and the expected payments after the SCRA adjustment. The SCRA period is in effect for the first two months, and thus you will see the interest rates lowered to 6% in the response body (and the recurring amount due lowered by the amount of the interest rate reduction for the two relevant months). The origination fee has also been canceled.

You’ll receive a response with either the actual post-SCRA adjusted payment plan or a preview of it. Below is a comparison of a payment plan prior to the SCRA adjustment, and the expected payments after the SCRA adjustment. The SCRA period is in effect for the first two months, and thus you will see the interest rates lowered to 6% in the response body (and the recurring amount due lowered by the amount of the interest rate reduction for the two relevant months). The origination fee has also been canceled.

Original payment plan (first 3 payment periods)

Adjusted payment plan (first 3 payment periods)

Adjusted payment plan (first 3 payment periods)

(*Certain fields omitted for brevity)

(*Certain fields omitted for brevity)

In addition to streamlining manual compliance with SCRA, Peach enables you to proactively offer the SCRA benefit to eligible borrowers. This is possible thanks to Compliance Guard™, which automatically monitors for borrower status changes. We can alert you when borrowers receive orders to active-duty service, and again when active duty ends. You can then proactively reduce the borrower’s interest rate to 6% for the exact duration of their deployment, without the borrower ever needing to contact you. As the CFPB eyes underutilization of SCRA benefits, this capability may evolve from a nice-to-have to a requirement.

Combining these subtle yet highly complex changes into a single, user-friendly tool is in line with our standard approach to feature work: building loan servicing solutions that are configurable, scalable, compliant and user-friendly.

Loan Replay: Programmatically managing retroactive changes

Peach’s Loan Replay capability is the engine that powers complex features requiring retroactive changes to loans. Here, we spend a little time—using SCRA as a use case—to examine the technical underpinnings of Loan Replay, and the intricate lending mechanics that make it necessary.

At their core, loan management systems act as highly complex state machines holding data for each individual loan. Lenders rely on these state machines first and foremost to accurately record and track a constantly evolving set of information constituting a loan’s state, and to ensure each change cascades correctly to update the rest of the loan’s state.

In a simplified world, the past is the past, and any event causing a change in loan state—payments, interest accrual, charge-offs, etc.—results in a permanent state transition. But in reality, there are myriad changes that can impact a loan’s history—whether it’s reversing a payment previously marked as successful, reversing a previous charge-off, or, in the case of SCRA, lowering an interest rate effective as of a past date.

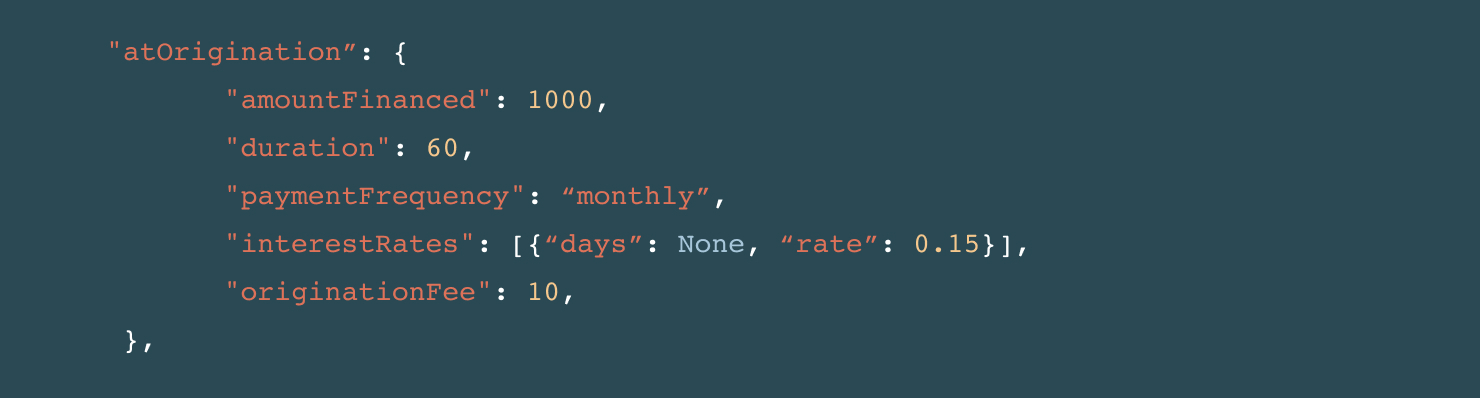

Let’s say we have a simple installment loan that was originated on January 1, 2023 with the following terms:

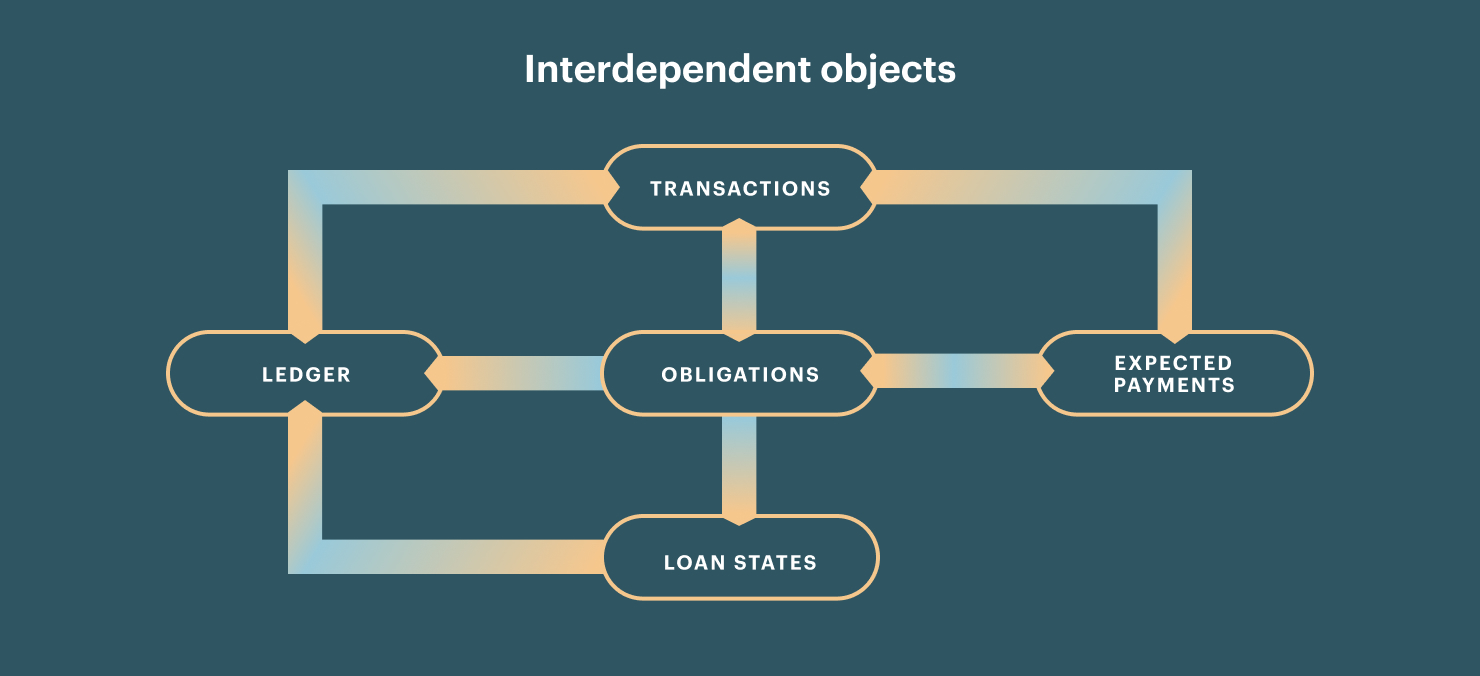

Because there are many stakeholders consuming information about a loan throughout its life—business, operations, finance, accounting, payment processors, credit bureaus and investors, to name a few—a single loan requires that a host of data points be recorded with precision. This includes, but is not limited to, borrower data, financial data, accounting data and payment data.

Because there are many stakeholders consuming information about a loan throughout its life—business, operations, finance, accounting, payment processors, credit bureaus and investors, to name a few—a single loan requires that a host of data points be recorded with precision. This includes, but is not limited to, borrower data, financial data, accounting data and payment data.

What’s more, these data points need to be represented in highly specific ways. Where operations may need only a high-level view of the numbers, finance will ultimately need the nitty gritty story of a loan told in accounting debits and credits. Data analysts and credit bureaus require tracking of delinquency in specified ways, while borrowers only want to know whether they are current or overdue. It becomes clear that any event impacting a loan requires deterministic updates across a large surface area.

Moreover, a key characteristic of loan management is tight coupling. Firstly, we see this between various facets of a loan. Taking the example above, let’s say the borrower makes a payment several days into the loan. That single action will lead to a cascade of changes, including generating new transaction data, generating accounting entries to deplete various receivables buckets, recalculating the interest and principal splits on the borrower’s payment plan, and updating whether the loan is current or overdue.

Secondly, we see tight coupling between each successive event in the life of a loan. A payment event in the first period will impact the amount of interest that will be subsequently accrued on a daily basis (as the principal balance has been lowered), which impacts the amount of interest, fees, and principal receivables to be moved on the due date. Put simply, the state of a loan at any given time depends on the entire history of inputs—not just the most recent one. This means that the history of a loan—when payments were made or not made, when interest rates changed, when fees were booked, etc.—is an interconnected chain of events. One change not only immediately impacts the loan, but adding, removing or changing one piece means changing everything about a loan’s state from that adjustment onward.

Secondly, we see tight coupling between each successive event in the life of a loan. A payment event in the first period will impact the amount of interest that will be subsequently accrued on a daily basis (as the principal balance has been lowered), which impacts the amount of interest, fees, and principal receivables to be moved on the due date. Put simply, the state of a loan at any given time depends on the entire history of inputs—not just the most recent one. This means that the history of a loan—when payments were made or not made, when interest rates changed, when fees were booked, etc.—is an interconnected chain of events. One change not only immediately impacts the loan, but adding, removing or changing one piece means changing everything about a loan’s state from that adjustment onward.

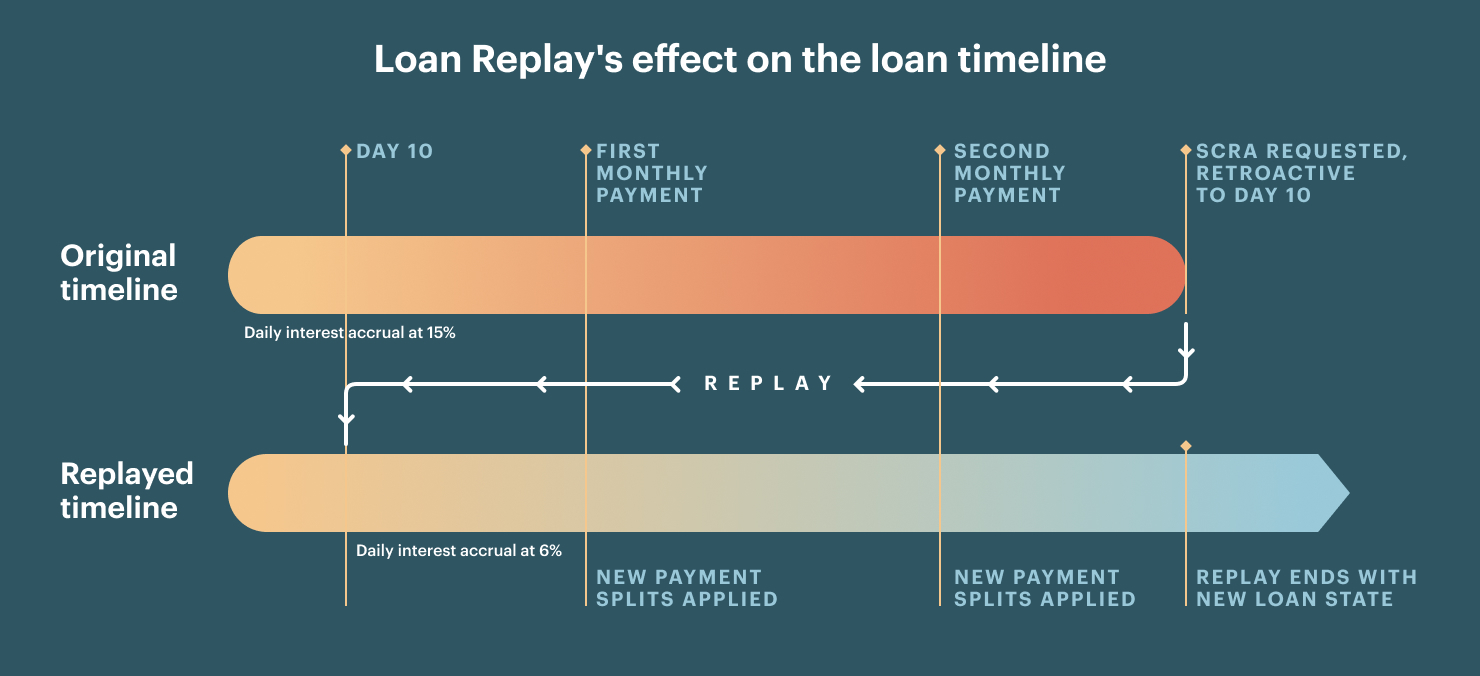

In the example above, let’s say that 80 days into the loan, after two payments were made, the customer requests an SCRA relaxation effective as of 10 days into the loan. How do we update this loan appropriately?

If the interest rate has to be lowered as of day 10 of the loan, then everything that happened subsequently will be subject to change. The daily interest accruals from the tenth day onward will change, and the first payment will now waterfall different amounts of interest, fees and principal. Depending on the amounts of the payments, a loan that was overdue may now be current, given the lowered interest rate.

If the interest rate has to be lowered as of day 10 of the loan, then everything that happened subsequently will be subject to change. The daily interest accruals from the tenth day onward will change, and the first payment will now waterfall different amounts of interest, fees and principal. Depending on the amounts of the payments, a loan that was overdue may now be current, given the lowered interest rate.

Loan Replay™ was built for use cases such as this. Broadly speaking, our architecture is built to keep detailed track of all mutable and interdependent events in the life of a loan, so that when any change is made to that event timeline or loan state, we can rewind to the time of the event in question, rewind the loan state, and create a new timeline in light of that change. In the case of SCRA, after handling interest rate changes and fee cancellations we reverse the state of the loan to the appropriate point in time, then replay the loan, recalculating the payment plan, re-accruing interest, re-applying payments and re-moving balances in light of the new reality, so that the present receives a new loan state.

The breadth of loan data needing to be adjusted means that rewriting loan histories requires the right design and abstractions, and having a built-in layer of abstraction to handle retroactive changes is the only feasible approach. Because of our team’s combined experience in the real world of lending, we know that the need to edit past loan events is inevitable. So we’ve designed a system that makes these changes as painless and automated as possible.

The breadth of loan data needing to be adjusted means that rewriting loan histories requires the right design and abstractions, and having a built-in layer of abstraction to handle retroactive changes is the only feasible approach. Because of our team’s combined experience in the real world of lending, we know that the need to edit past loan events is inevitable. So we’ve designed a system that makes these changes as painless and automated as possible.

–

Though lending infrastructure is complex, lenders must find ways to balance regulatory compliance with innovation toward growth. Peach is designed to give you the best of both worlds. Contact us to learn more.